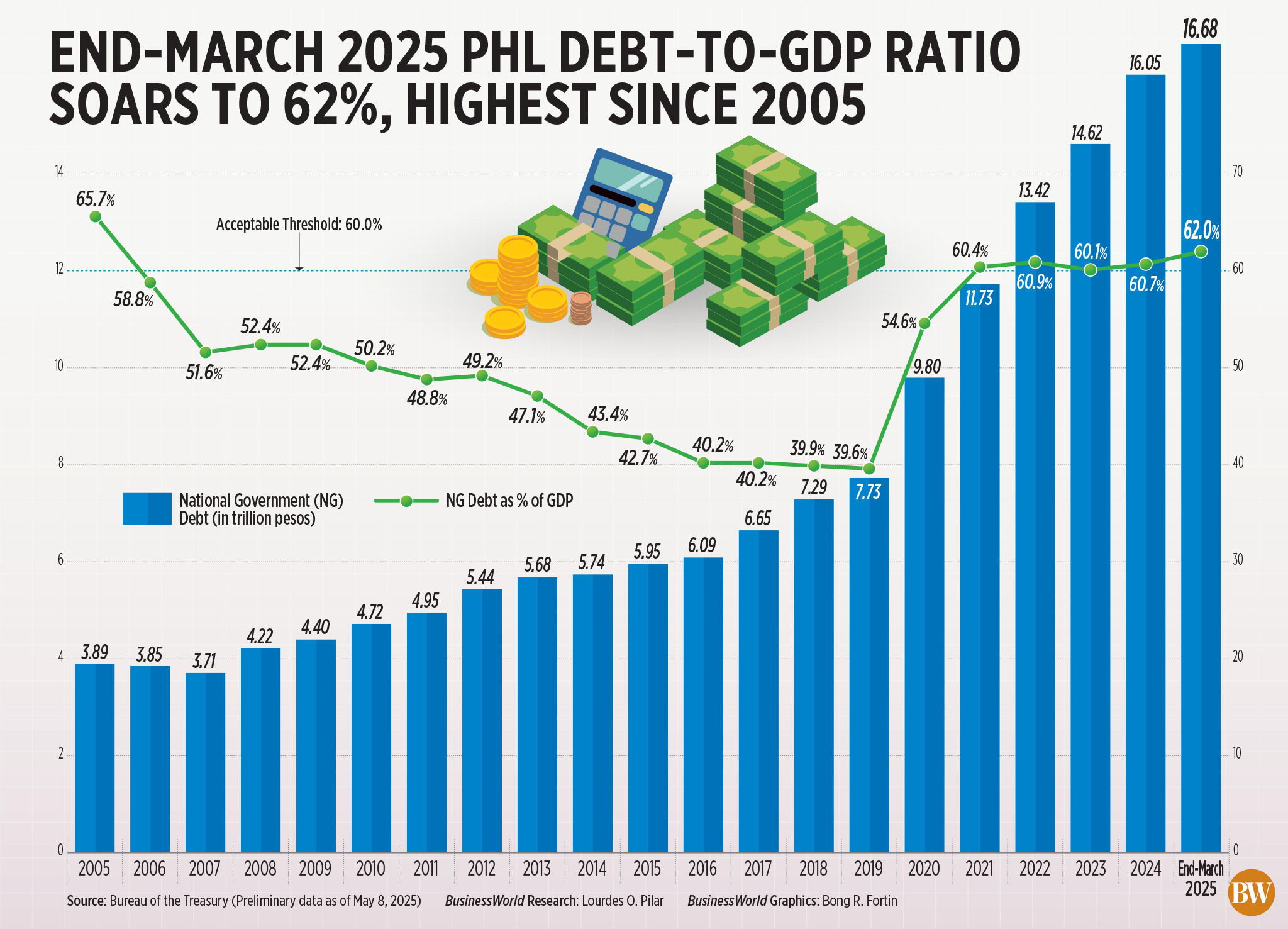

NATIONAL GOVERNMENT (NG) debt as a share of gross domestic product (GDP) rose to 62% at the end of the first quarter, the highest in 20 years.

The first-quarter reading represented a significant jump from the 60.7% posted at the end of 2024, indicating a setback to the Medium-Term Fiscal Framework. The government had been seeking to bring the ratio down to 60.4% by the end of 2025, and to 56.9% by 2028.

According to the Treasury, NG outstanding debt was at a record P16.68 trillion at the end of March, against P16.63 trillion a month earlier.

Pantheon Macroeconomics Chief Emerging Asia Economist Miguel Chanco said he suspects “some fiscal slippage” in the debt consolidation process due to the US trade war.

He said the government could be anticipating “a bit less revenue than planned and having to spend more to cushion the impact on growth. Ultimately… this will mean the authorities having to borrow more than previously expected.”

Mr. Chanco had forecast that the deficit will shrink only modestly to 5.5% of GDP, compared to the government’s expectation of 5.3%.

Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said this is “not a good signal” as it moved away from the 60% ceiling deemed suitable for developing countries. He noted that “soft GDP data led to a lower denominator and (produced) a higher NG debt-to-GDP ratio.”

He also said that in the coming months, the outstanding NG debt could hit new records as the NG resorts to borrowing in response to the Trump tariffs.

He said it was critical to keep the sovereign credit rating at 1-3 notches above investment grade “to lower borrowing costs and obtain favorable terms for the National Government.”

GlobalSource Partners Country Analyst and former Bangko Sentral Deputy Governor Diwa C. Guinigundo said sees no connection to US tariff policy as the Philippines benefits from a lower tariff of 17% compared to many of its neighbor.

He said debt stock is likely to further increase, noting that the debt was P16 trillion at the end of December.

“Of course, it’s not straightforward to add P600 million every month for three months. I’m sure there will be quarters when the additional debt will be lower and then higher, lower, higher,” Mr. Guinigundo said.

Mr. Guinigundo also said in the absence of any additional tax or non-tax revenue, the government will really need to raise funds through borrowing.

Finance Secretary Ralph G. Recto remained firm in his “no new taxes” position for the rest of the Marcos administration. — Aubrey Rose A. Inosante